In Part 1 of The Weekly Options Mastery Report we discuss The 5 Most Effective Options Trading Strategies intelligent traders are using to generate weekly profits (read below). Stay tuned for Part 2 where we discuss how to easily and efficiently identify attractive weekly options trade candidates every day…

Weekly options provide traders with the flexibility to implement short-term trading strategies without paying the extra time value premium inherent in the more traditional monthly expiration options. Thus traders can now more cost-effectively trade one-day events such as earnings, investor presentations, and product introductions. Flexibility is nice and all, but you are probably asking yourself, what specific strategies should I use to generate weekly profits from weekly options? Well I’m so glad you asked; let’s take a look now at 5 Most Popular Weekly Options Trading Strategies:

1. Covered Weekly Calls: Looking to generate some extra premium income in your portfolio? Well look no further, I have the strategy for you: Weekly Options Covered Calls. In essence, what you are looking to do in this strategy to is to sell weekly call options against existing stock holdings (covered calls) or purchase shares and simultaneously sell weekly call options against the new stock holding (buy-write). The weekly expiration of the sold call options allow you to collect additional income on your position, similar to a dividend but paying out each week. Over time the covered call strategy has outperformed simple buy-and-hold strategies, providing greater returns with two-thirds the volatility. However if shares of the underlying move meaningfully higher and through the sold strike, your return will likely be lower than if you didn’t sell the calls (though still positive!!!). We use this unique trading tool to screen for potential weekly covered call candidates and post a sampling of our trades each week so stay tuned.

2. Because of the exponentially high time decay in weekly options, most traders prefer to sell weekly options and understandably so. In the covered call strategy highlighted above traders are able to collect the rapid time decay by selling the weekly calls against a long stock position. Selling naked puts, in theory (put-call parity) is equivalent to a buy-write strategy though skew and margin requirements alter the picture a bit. I guess what I’m trying to say is, all things being equal I’d prefer to sell weekly options, however there are times when I’d like to purchase weekly options for the potential to experience larger, potentially uncapped gains. Under these circumstances I recommend purchasing deep-in-the-money (DITM) weekly options. Focusing on DITM weekly options, options with a delta in excess of ~80% you can effectively limit the rapid time decay in the long weekly option as the high delta causes the long weekly option position to act move like stock (delta of 0.80 means the option will move $0.80 for every $1.00 move in the underlying). This is a phenomenal way to take advantage of option leverage and limit decay.

3. Credit spreads are popular because they allow traders to sell upside (call spreads) or downside (put spreads) levels with a locked-in risk-reward from the trade outset. For instance say you believe stock XYZ will not move above the $80 level over the next week and you’d like to express this thesis in the form of weekly options. One way to do this is to simply sell the $80 weekly call option. Unfortunately without the underlying stock, this weekly call option sale would require a substantial amount of margin within your portfolio, as the maximum potential loss on the trade is theoretically infinite. However, you can reduce the max potential loss and margin requirement by simply purchasing a higher strike call (i.e. $85) to hedge your short weekly call position. You would then be short the $80-$85 weekly call spread in XYZ, having collected net premium with a max loss potential of the strike width ($85-$80) – (collected premium).

4. Out-of-the-Money (OTM): Otherwise known as “lottery tickets”, traders at times like to purchase way out of the money weekly options in hopes that a tiny investment could yield enormous returns. It happens, don’t get me wrong, but this strategy generally entails weeks and weeks of small losses and ideally a huge win to make up for the cumulative losses. The “lottery ticket” strategy is oftentimes used in cases of M&A speculation, FDA Announcements, and outsized earnings predictions.

5. Weekly Options Calendar Spreads: The Options Trading Signals guys do a pretty good job of covering calendar spreads in the Profitable Options Strategies report but here’s a nice summary of the weekly options calendar spread strategy from a recent OTS report:

One of the new opportunities presented by the arrival of these recently available weekly options is the ability to trade what I call “hit and run” calendar spreads. Remember that a calendar spread is a two-legged spread constructed by selling a shorter dated option and buying a longer dated option. The profit engine is the relatively faster decay of time premium in the shorter dated option.

Calendar spreads reliably achieve their maximum profitability at the expiration Friday afternoon of the short leg when price of the underlying is at the strike price. Prior to the recent availability of these weekly options, calendar spreads were typically constructed with around 30 days to expiration in the short leg.

In these classically constructed calendars, risks are two:

1. Movement of price of the underlying beyond the limits of profitability

2. Volatility crush of the longer dated option which the trader owns.

Hit and run calendars differ in risk somewhat. Volatility moves rarely occur at anywhere close to the rapid pace of price movement. Because of this characteristic, the primary risk in these short duration calendars is price of the underlying. The occasional occurrence of spiked volatility in the short option significantly increases the probability of profitability as the elevated volatility decays to zero at expiration.

One of the very liquid underlyings that has actively traded options is AMZN. At mid day August 29, AMZN was at $205.50 and continuing to trend higher from a basing pattern. A quick look at the options board showed the weekly 210 strike option, having 4 days of life left and consisting entirely of time (extrinsic) premium, was trading at a volatility of 42.9% while the September monthly option I would buy had a volatility of 41.6%.

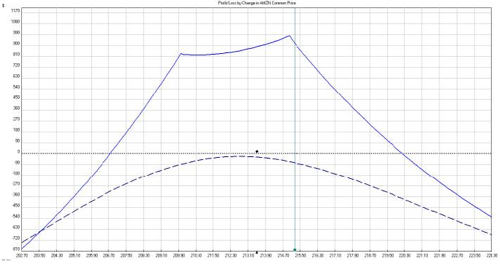

This situation is called a positive volatility skew and increases the probability of a successful trade. I entered the trade and owned the resulting P&L graph:

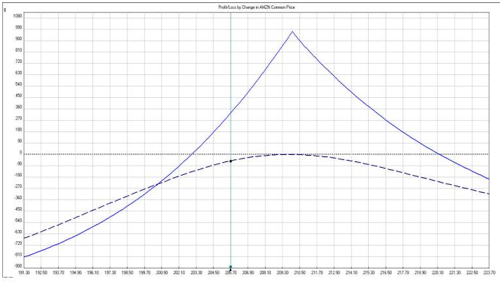

I continued to monitor the price, knowing that movement beyond the bounds of my range of profitability would necessitate action. By mid day on August 31, 48 hours into the trade, the upper limit of profitability was being approached as shown below:

I continued to monitor the price, knowing that movement beyond the bounds of my range of profitability would necessitate action. By mid day on August 31, 48 hours into the trade, the upper limit of profitability was being approached as shown below:

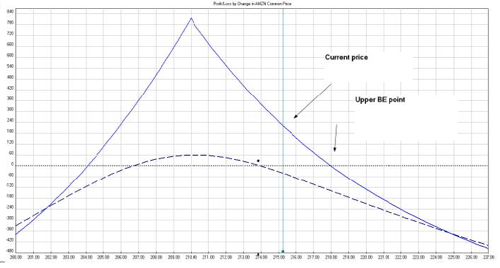

Because price action remained strong and the upper breakeven point was threatened, I chose to add an additional calendar spread to form a double calendar. This action required commitment of additional capital and resulted in raising the upper BE point from 218 to a little over 220 as shown below. Hit and run calendars must be aggressively managed; there is no time to recover from unexpected price movement.

Because price action remained strong and the upper breakeven point was threatened, I chose to add an additional calendar spread to form a double calendar. This action required commitment of additional capital and resulted in raising the upper BE point from 218 to a little over 220 as shown below. Hit and run calendars must be aggressively managed; there is no time to recover from unexpected price movement.

Shortly after adding the additional calendar spread, AMZN retraced some of its recent run up and neither BE point of the calendar was threatened. I closed the trade late Friday afternoon. The indication to exit the trade was the erosion of the time premium of the options I was short to minimal levels.

The results of the trade were a return of 67.5% on maximum allowable managed capital risk and a return of 10.6% on committed capital. If the second calendar had not been needed to control risk, the returns would have been substantially higher.

This is just one example of the use of options in a structured position to control capital risk and return significant profit with minimal position management. Such opportunities routinely exist for the knowledgeable options trader.