Google 3Q Earnings Volatility Analysis & HPQ Weekly Options Activity

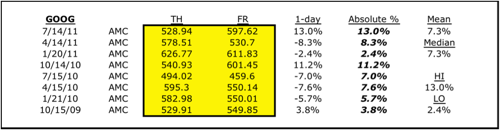

Google (GOOG) is scheduled to report 3Q financial results today after the close. The Street is expecting EPS of $8.74 on revenue of $7.2 billion. Shares of GOOG have exhibited decent volatility around earnings releases averaging a +/-7.3% around its last 8 earnings reports with a high of 13% emanating from last quarter’s results (see chart below). Using yesterday’s closing prices, the 550 weekly options straddle is pricing in a ~6.5% move which seems about fair.

Google (GOOG) 1-Day Earnings Volatility

The VIX continues its descent, finishing the day at 31.26, slightly above 2-month lows. Unusual put buying in the VIX over the past 2 days suggests traders are anticipating even further declines in market volatility, a generally positive sign for stocks.

Hewlett-Packard (HPQ) weekly options were active yesterday with traders continuing to buy 26-strike calls. This short-term call buying has been consistent in the name all week. New HPQ CEO Meg Whitman is weighing a variety of strategic alternatives in attempts to reverse the fortunes of the struggling tech company. Surprisingly, volatility expectations have remained rather steady with 30-day IV trading roughly in line with 30-day HV. May take a shot at some deep in-the-money calls here.

Hewlett-Packard 30-Day Volatility Chart

Similar Posts:

- Apple 4Q Earnings Volatility Preview

- HPQ & XLF Weekly Options Trades Highlighted

- The Weekly Options Report: Here Comes The Pain

Mr. Saunders serves as Mesa’s Vice President of Marketing, bringing with him a wealth of experience in strategic marketing and operations. In this role, Mr. Saunders is responsible for overseeing all marketing activities, utilizing a blend of traditional and digital strategies to enhance brand presence and profitability, managing a multi-million dollar marketing budget across various media platforms, and leading the continued implementation of CRM systems to streamline customer engagement and drive business growth.