HVAC Marketing Insights: Google Local Service Ads Lead Volume Down 30% in September 2024

Each month Jon Torrey and his team over at The Data Driven Trades examine trends in HVAC marketing and more specifically how Google Local Service Ads (GLSA) are performing across a sample of 25 HVAC businesses across the US.

Results from his analysis over the last couple months have shown a general slowdown in GLSA lead volume and the trend continued into September. Let’s take a closer look at the key takeaways from the report below:

Declining Lead Volume Signals Market Shifts

Torrey highlights a significant downturn in GLSA lead volume, with a 30% decrease from August to September and a 32% year-over-year decline. This trend is concerning, especially for companies that rely on GLSA for the bulk of their lead generation. For HVAC businesses, this underscores the importance of diversifying marketing channels to mitigate risks associated with fluctuating lead generation.

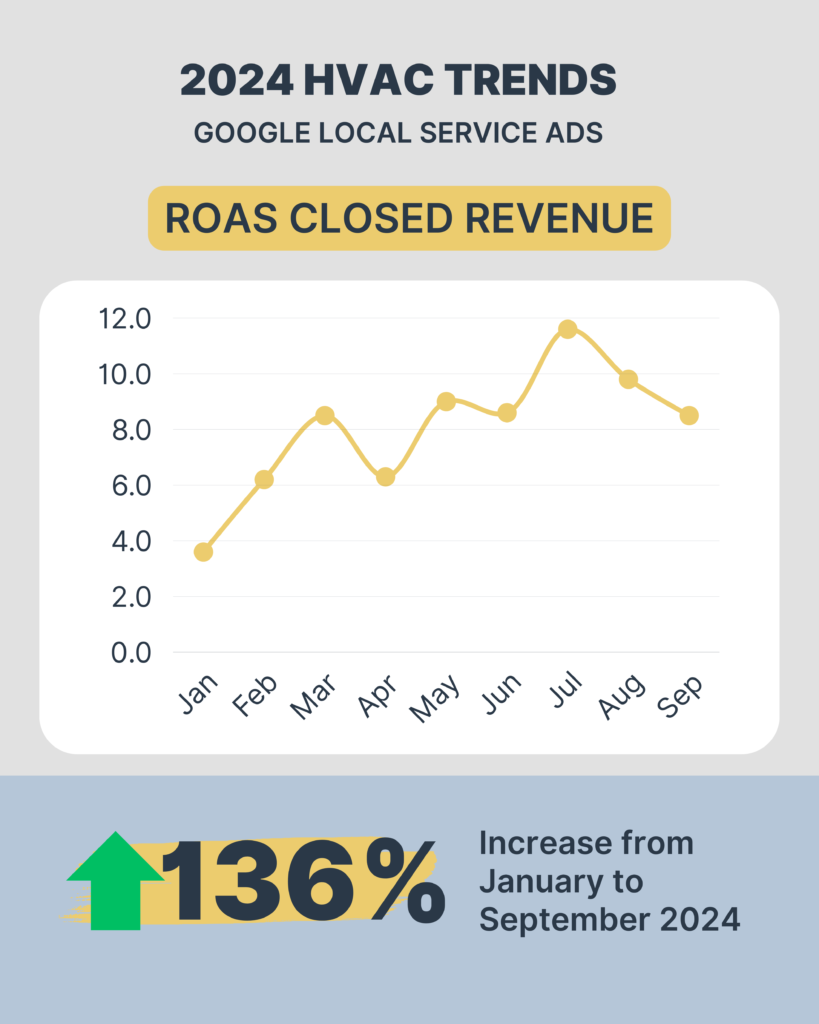

Enhanced Return on Ad Spend (ROAS) Despite Reduced Spend

Interestingly, despite the drop in lead volume, the Return on Ad Spend (ROAS) potential increased to 16x in September. This improvement is primarily due to a 23% reduction in ad spend, allowing businesses to achieve higher efficiency with fewer resources. Lower spending makes it easier to attain a higher ROAS, as fewer leads can still convert into substantial revenue. For HVAC companies, optimizing ad budgets can lead to better financial performance even in a declining lead environment.

Profitable Closed Revenue a Solid Sign

While the ROAS potential showed some improvement, the actual ROAS closed stood at a respectable 8.5x, indicating that the revenue generated from closed deals remained profitable. The generally high-quality nature of GLSA leads typically lends itself to solid closed revenue return so this isn’t much of a surprise.

Source: https://thedatadriventrades.substack.com/

Customer Acquisition Costs (CAC) Continue a Downward Trajectory

The analysis reveals that the Customer Acquisition Cost (CAC) decreased by 17% year-over-year, although customer spending also fell by 32%. Lower CAC presents an opportunity for HVAC businesses to acquire customers more cost-effectively. However, the simultaneous decline in customer spend emphasizes the need to not only attract customers but also to maximize their lifetime value through excellent service and upselling strategies.

HVAC Marketing Diversification is Imperative

Perhaps the most critical insight from the analysis is the necessity for marketing diversification. With GLSA performance showing increased volatility, HVAC businesses must explore alternative advertising channels to ensure consistent lead generation and revenue growth. Investing in a mix of digital marketing strategies, such as search engine optimization (SEO), pay-per-click (PPC) advertising, and social media marketing, can provide a more stable foundation for business growth.

Similar Posts:

- State of Marketing Q4 2024: Key Takeaways from Leading Home Improvement Lead Generation Marketers

- Lessons from the Legal Sector: Maximize Home Services ROI with a Balanced Approach

- Google Ads Exposed: Home Services Marketing Insights From Over 1 Million Ad Tests

Mr. Saunders serves as Mesa’s Vice President of Marketing, bringing with him a wealth of experience in strategic marketing and operations. In this role, Mr. Saunders is responsible for overseeing all marketing activities, utilizing a blend of traditional and digital strategies to enhance brand presence and profitability, managing a multi-million dollar marketing budget across various media platforms, and leading the continued implementation of CRM systems to streamline customer engagement and drive business growth.

Leave a Reply

Want to join the discussion?Feel free to contribute!