Selling Energy Sector Skew – XOP

The energy sector, along with the rest of the market, has taken a beating over the last month but with the price of crude approaching significant support we searched for ways to monetize a “bottoming” view using options. For purposes of our analysis we examined the XOP, the SPDR S&P Oil & Gas Exploration & Production ETF, in hopes of identifying trends and trading themes in the ETF as well as in the component names.

- XOP Volatility & Skew Analysis: XOP 3 month at-the-money implied volatility of 42% currently ranks in the 71st percentile of 52-week volatility levels. 3-month skew which we define as 25-delta put volatility minus 25-delta call option volatility is currently trading around year highs levels. The combination of high implied volatility and elevated skew naturally led us to consider various strategies that involved the sale of downside puts.

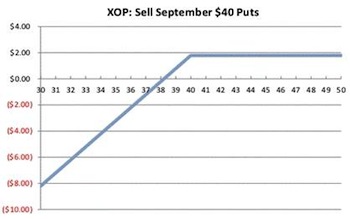

- Sell XOP Sep $40 Puts: With identified support in the $40 region we recommend investors take advantage of elevated implied vol and skew by selling the Sep $40 puts. Using yesterday’s closing prices the Sep $40 puts could be sold at $1.75. Maximum profit on the put sale is limited to the premium collected, $1.75, which would represent a stand-still return of 3.6%. The trade remains profitable with shares of the XOP trading anywhere above $38.25 (Strike – Premium) upon expiration. Shares last traded near $38 in August of 2010. Investors would need to be comfortable getting long XOP should shares trade below $38.25 at expiration. A graphical representation of the P/L of the Sep 40 put sale is highlighted below:

- Recent Energy Related Trading: Yesterday we saw investors selling 15k Sep $43 puts in the XOP outright collecting $2.54 in the process. Other notable recent energy trading included buyers of 15k XLE June 65-60 put spreads, sellers of 9k June 63 puts in the XLE, buyers of July 38 calls in the OIH, and buyers of 30k Sep 47-43 put spreads in the XOP.

Selling Puts On Energy XOP ETF

Similar Posts:

- Gold A Safe Haven No More? – GLD Options Trading Strategy

- Buy Protection When You Can, Not When You Need To…

- Weekly Options Traders Positioning For Further Downside In Netflix

Mr. Saunders serves as Mesa’s Vice President of Marketing, bringing with him a wealth of experience in strategic marketing and operations. In this role, Mr. Saunders is responsible for overseeing all marketing activities, utilizing a blend of traditional and digital strategies to enhance brand presence and profitability, managing a multi-million dollar marketing budget across various media platforms, and leading the continued implementation of CRM systems to streamline customer engagement and drive business growth.

Leave a Reply

Want to join the discussion?Feel free to contribute!